ABOUT TAXPORTAL

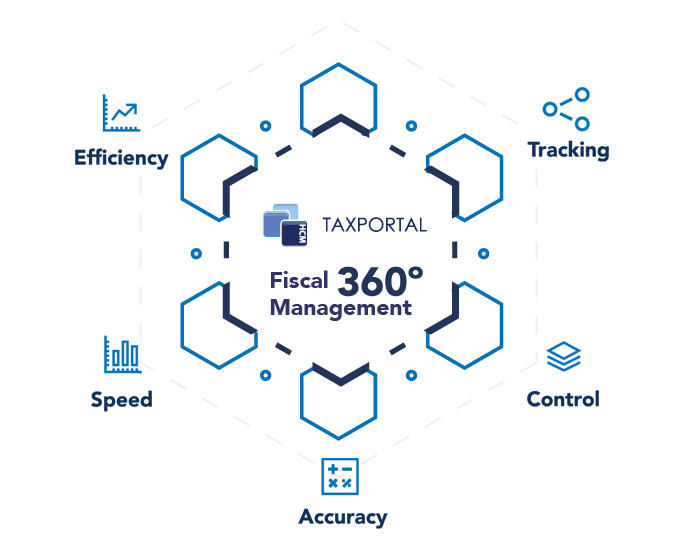

TaxPortal is the leading technological tax solution in the Mexican market, specifically developed to meet the fiscal needs of companies operating in Mexico. Our platform is constantly evolving to adapt to the constant changes in the requirements of the tax authority, understanding their procedures and making tax compliance increasingly simple for you. Want to learn more about how TaxPortal can transform the fiscal management of your company? Click "Learn more" and discover how we can help you. If you want to learn more about how our platform works, request a demo by clicking "Demo". We're ready to help!